To ensure the stable development of the ecosystem, Turing Cat Coin levies a fixed transaction tax of 3.5% on transaction behaviors, which is agreed upon by both the buyer and the seller.

Purchase tax: 3.5%

1.5% LP dividend: Reward liquidity providers to enhance market liquidity

1% node dividend: Incentivize node participation to ensure network security and stability

0.5% token holding dividend: Rewarding long-term token holders and encouraging token holding behavior

0.5% destruction: Gradually reduce the total amount and enhance scarcity

Sales tax: 3.5%

When selling, the transaction tax is distributed the same as when purchasing to ensure the balanced interests of all parties in the ecosystem.

1.5% LP dividend

1% node dividend

0.5% cash dividend

0.5% destroyed

The Turing Cat Coin achieves extreme scarcity through an initial issuance of a total of 100,000 pieces, gradually deflating to a final 1,000 pieces. The deflationary mechanism, combined with trading burn and daily pool burning, ensures a continuous decline in the total market volume, thereby supporting the long-term growth of the coin price and the value of the coin holders.

A fixed transaction tax of 3.5% is charged for each transaction (buy or sell), which is intelligently allocated for different purposes:

LP dividend (1.5%) : Reward liquidity providers to ensure stable market liquidity

Node dividend (1%) : Incentivizes nodes to participate in network maintenance and governance

Coin holding dividend (0.5%) : Reward long-term coin holders to enhance user loyalty

Destruction (0.5%) : Reduce circulation volume and enhance scarcity

Ensure the fair and efficient operation of the ecosystem through automatic allocation via smart contracts.

Turing Cat introduces a daily bottom pool automatic deflation mechanism:

Every 24 hours, 10% of the total amount of the bottom pool is burned, of which 8% is sent to the death address for permanent destruction

1.5% will be allocated to node shareholders and 0.5% to token holders

This mechanism reduces the circulation volume while achieving a passive spiral increase in the coin price and a synchronous growth in the returns of coin holders.

Turing Cat builds a three-tier dividend system:

LP dividend: Liquidity providers share trading profits

Node dividend: Reward network nodes to ensure system security and stability

Token dividend: Long-term token holders share the value increment brought by deflation and trading

This multi-level dividend design not only incentivizes ecosystem participants but also ensures that every type of stakeholder can benefit from the growth of the currency, achieving sustainable development.

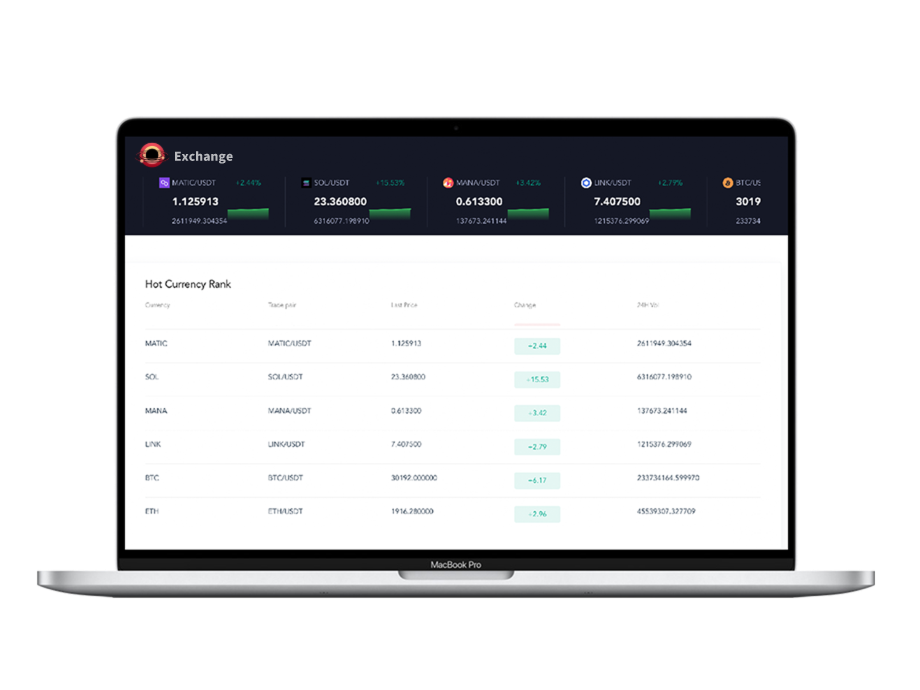

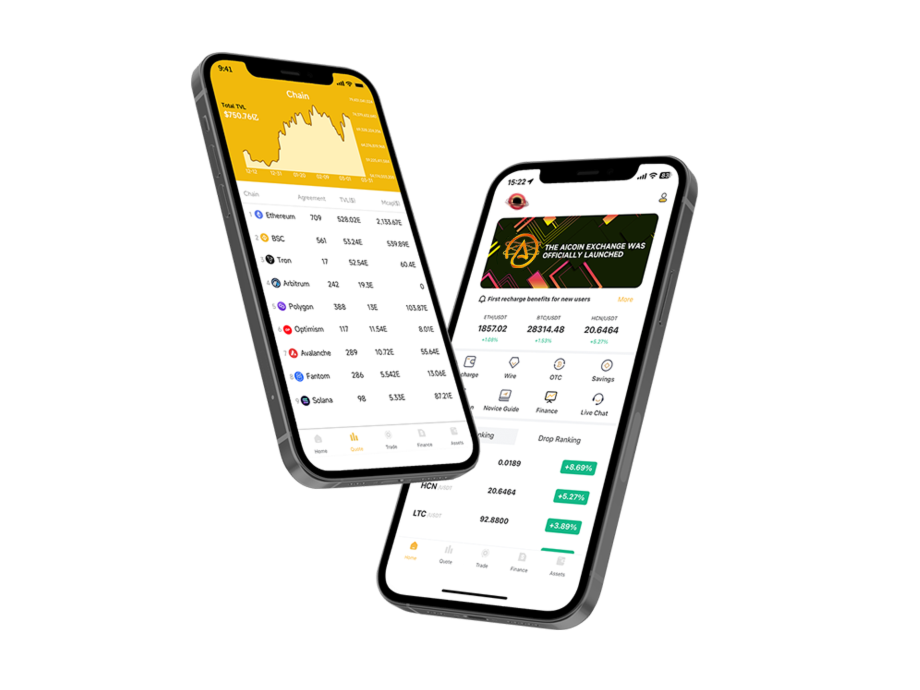

Turing Cat Coin, as a deflationary token, can be freely bought and sold on decentralized exchanges (DEX) and centralized trading platforms (CEX). With the daily deflation mechanism and the advantage of scarcity, the long-term potential of the coin price is considerable. Meanwhile, the distribution of transaction taxes ensures liquidity and node returns, attracting investors to actively participate in the market.

Turing Cat has designed a multi-level token holding dividend system to support the returns of token holders in both the primary and secondary markets. Regardless of trading activity, long-term coin holders can enjoy the passive appreciation and dividend rewards brought by the daily automatic deflation. This mechanism encourages users to hold for the long term, while forming a stable currency value support and community activity level.

Nodes play a core role in the Turing Cat ecosystem, participating in transaction verification, network maintenance, and governance decision-making. Through the node dividend mechanism, nodes obtain stable returns while enhancing network security and the degree of decentralization. This market not only attracts technical participants but also encourages community members to take part in project construction through nodes, achieving win-win value.